Google Ads News: September 2025

Last Updated on: 24th November 2025, 12:47 pm

Welcome to September 2025 Google Ads news! This month, Google’s changes feel like pieces of a bigger pattern. We have more visibility into Demand Gen reporting, tweaks to Performance Max, new values for offline visits, and more.

On their own, each update tweaks a dial. Together, they show us where Google is steering advertisers next.

Let’s take a look!

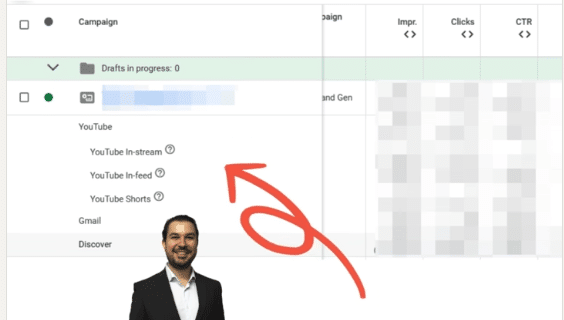

Google Ads News: Demand Gen Breaks Out YouTube Placements

Google has stopped hiding YouTube performance inside Demand Gen. You’ll now see separate metrics for In-Stream, In-Feed, and Shorts without any extra setup. The split is visible directly in the Campaign view.

Credit to Georgi Zayakov for spotting it first.

Why This Google Ads News Matters

Up until now, Shorts clicks were mixed in with In-Stream, and In-Feed was buried in the same reporting line.

If, for example, Shorts were driving high-quality conversions, you couldn’t see it. You’d keep feeding budget into placements that never produced a booked call.

This Google Ads news matters because the creative and intent profile is completely different across formats:

- Shorts: 15-30 second hooks, mobile-first, great for sparking initial interest.

- In-Stream: Longer pre-roll, intrusive by nature, often skippable. Performance swings wildly depending on creative strength.

- In-Feed: Click-driven, sits alongside organic content, better for engagement than bottom-funnel actions.

What to Do Next

- Pull the new segment data in every live Demand Gen account. Don’t assume Shorts or In-Stream are paying off, and check the actual CPA and conversion quality.

- If Shorts are driving consult form fills, shift more creative into that format and adjust bidding accordingly.

- If In-Stream is soaking impressions without conversions, scale it down or refresh the creative.

- Test distinct creatives for each placement. Don’t recycle a TV-style 30s spot across all three and expect clarity.

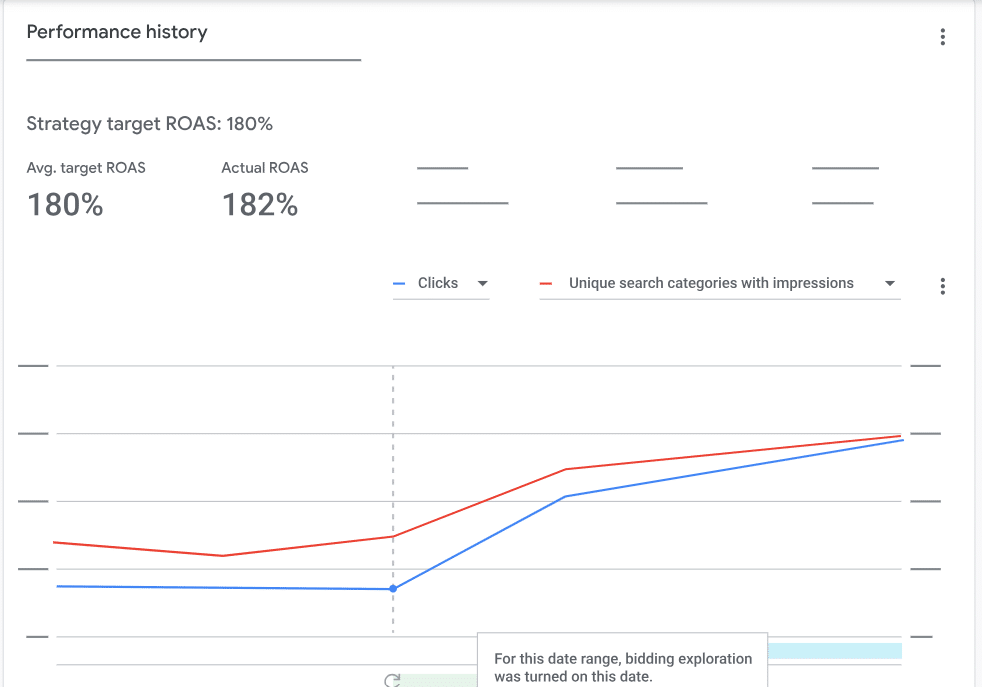

Performance Max Gets “Smart Bidding Exploration”

Google added a new toggle into Performance Max: Smart Bidding Exploration.

Flick it on, and Google will loosen your ROAS guardrails if it thinks it can bring in more conversions.

Google’s headline stat: an 18% increase in new query categories and a 19% lift in total conversions during tests. Sounds great. But the caveat is glaring: if the machine is chasing extra volume, your return on ad spend will almost certainly wobble.

Why It Matters

ROAS targets exist for a reason: they keep your spend disciplined. The moment you relax them, Google has permission to chase cheaper, lower-intent traffic.

Yes, you’ll see more conversions in the column, but will they be the kind of patients, customers, or leads you actually want?

I’ve seen this story before in Search: advertisers switch on “growth levers,” enjoy the sugar rush of extra conversions, and only later realise their margins are thinning because the new leads don’t close.

What to Do Next

If you’re testing this:

- Start small. Run the toggle in a single campaign with a clear baseline.

- Track quality, not just volume. Use offline conversion imports, CRM notes, or post-lead reviews to check whether those “extra” conversions have any value.

- Hold your nerve. If ROAS is non-negotiable in your business model, don’t be tempted. This feature is built for advertisers willing to sacrifice efficiency for growth.

Smart Bidding Exploration is Google’s way of nudging you further toward the “trust us” camp. By all means, test it – but test like a sceptic.

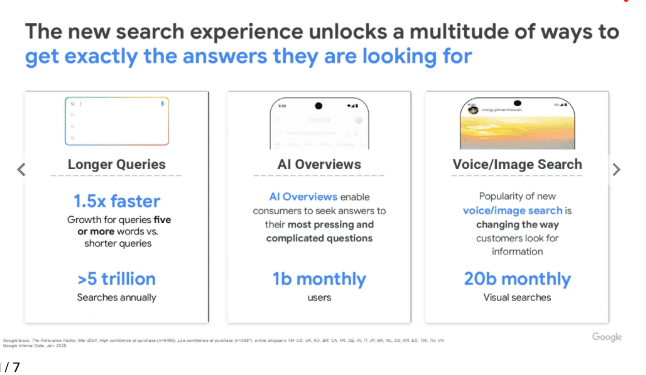

AI Max Google Ads News: Smarter Search Ads or Smarter Spin?

Google’s been busy pushing AI Max, its AI-powered ad suite for Search, with a 26-page pitch deck that tries to calm advertiser anxiety.

And now, as of September 2025, the beta’s been expanded globally across Google Ads, Ads Editor, Search Ads 360, and the API.

AI Max is pitched as a way to:

- Match ads to relevant searches (even ones you didn’t bid on).

- Dynamically tweak copy to fit user intent.

- Funnel clicks to your brand landing pages.

In theory, this means fewer missed opportunities and “smarter” ads without you lifting a finger.

However…

Here’s what’s also part of that reality:

- Brand safety: AI Max sometimes pulls the wrong text or makes risky leaps. For instance, skincare ad copy may cite the wrong clinical trial. That’s legally dangerous.

- Accuracy gaps: Sector nuances are often missed, with irrelevant links or mismatched imagery showing up.

- Spend leakage: Agencies are already flagging budgets drifting into placements they didn’t intend.

Google’s Reassurance Package

In the updated deck, Google stresses:

- Negative keyword lists and URL exclusions will be honoured.

- Creative will only be “lightly generated”, pulling from brand-approved sources, not fabricating claims.

- Advising against testing AI Max with campaigns under $50/day (translation: smaller advertisers, you’re not the priority).

So, it’s not the free-for-all some feared, but the guardrails still feel reactive rather than proactive.

What’s Next

Google is experimenting with placing Search and Shopping ads directly under AI Overviews, and will begin testing ads inside AI-generated answers in Q4 2025.

If that format sticks, AI Max won’t just control who you show up for. It will shape how your brand appears inside Google’s own AI narrative.

AI Max has the potential to become Google’s flagship Search product. But “potential” doesn’t pay your bills. Control and clarity do.

Until Google proves advertisers can trust both:

- Watch your budgets, particularly for hidden Display creep.

- Lock down your brand assets and exclusions before handing Google the keys.

- If you’re testing, run it on non-critical campaigns first. That way, you’ll see how far Google stretches your guardrails before putting high-value budgets at risk.

Google’s $220 Store Visit “Value”: Inflated ROAS or Real Insight?

Starting in October, Google will automatically add Store Visits as a primary conversion type, and they’re slapping a preset value of roughly $220 per visit into reports.

Unless you opt out, this new conversion value will roll straight into your ROAS metrics and bidding strategies.

On paper, that means your campaigns suddenly look like they’re generating more revenue and higher ROAS. But let’s be clear: these are modelled visits, not confirmed sales.

Why These Google Ads News Matter

I’ve spent enough years auditing accounts to know that inflated numbers can get dangerous fast.

If Smart Bidding thinks each store visit is worth $220, it will absolutely increase bids to chase more of them.

For multi-location retailers, this is especially tricky. A store visit could mean someone popped in to use the loo or ask for directions. It’s not the same as a new patient for a dentist or a $5,000 sale.

What To Do Next

- Check your emails. Google’s already notifying accounts about when this flips on. Opt-out dates vary, some as early as October 1st.

- Opt out if it doesn’t reflect reality. You can fill out the form or manually remove the conversion after it’s added.

- If you keep it, set your own value. Don’t just accept Google’s $220 figure. Pull real sales data and estimate what an average store visit drives for your business. That way, you’re not giving Smart Bidding fantasy numbers to optimise around.

- Segment reporting. Watch how your “real” online conversions compare to these modelled store visits. If performance suddenly spikes, check what’s fueling it.

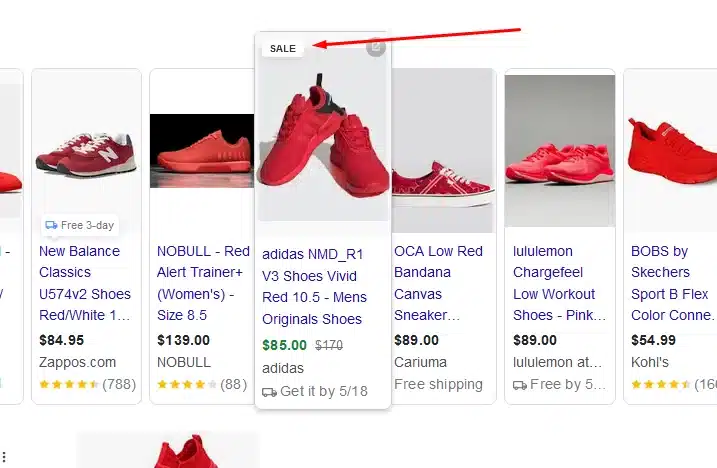

Google’s Pricing Playbook: Why Sale Annotations and Discounts Matter in Shopping

Google’s just published a new “Understanding Product Pricing” guide, and while most advertisers would skim past it, I think it’s worth a closer look.

Pricing is one of the most visible signals in Shopping ads, and the annotations around it (sales, discounts, loyalty perks) can make or break whether a shopper clicks.

The Core Pricing Layers

Google splits product pricing into three simple buckets:

- Price: Your standard product price.

- Sale price: A temporary discount that Google highlights with side-by-side “was/now” pricing.

- Price drop annotation: An automatic tag showing when a product has genuinely fallen in price, making it stand out as a deal.

That last one is worth noting: you don’t control when the “price drop” flag shows up. Google decides based on historical data, which means if your pricing is erratic, you could end up with no annotation even when you think it deserves one.

Advanced Options for These Google Ads News

The new guide also covers more complex tactics that too many advertisers miss:

- Automation: Automatic updates if your feed and landing page prices don’t match (saves you from disapprovals), plus AI-driven discounts across your inventory.

- Special programs: Regional pricing, promo-based discounts, and loyalty-specific pricing, which is useful if you want to reward members without discounting for everyone.

- Flexible payments: Showing instalment or subscription breakdowns directly in your ads, which is becoming a big trust-builder in categories like electronics, beauty, and fitness.

Why This Matters

Shoppers don’t read your Merchant Centre settings; they see your price in the SERP.

If your competitors are using annotations and you’re not, your ad instantly looks less attractive – even if your product is the better option.

There are several Shopping accounts where adding clear “was/now” sale annotations bumped CTRs by 10-15% during promo periods. And with loyalty-specific pricing, you can finally use Shopping to reinforce brand stickiness instead of just being the cheapest option on the feed.

What To Do Next

- Audit your feeds. Are your prices syncing cleanly with your landing pages? Any mismatch can kill visibility.

- Plan sale windows carefully. Don’t just drop the price; line it up with when Google can annotate it.

- Test loyalty pricing. If you’ve got a rewards program, connect it to Merchant Centre – it’s a quick way to differentiate.

- Explore flexible payments. Especially in higher-ticket categories, showing “$50/month” instead of “$600 upfront” can change click behaviour.

The Takeaway for September’s Google Ads News

If you step back from the Google Ads news headlines, the throughline is clear: Google is collapsing complexity on their side, while pushing advertisers to absorb it on ours.

Reporting splits, automatic conversion values, AI-driven bidding “explorations,” creatives stitched into new surfaces…all of these changes shift how performance is measured and controlled.

The real challenge isn’t whether the tools are good or bad; it’s whether you have the discipline to separate genuine gains from inflated ones.

So as you test these updates, measure on your terms.

In the meantime, if you’d like to brush up on the fundamentals while Google keeps shifting the playing field, grab a copy of my best-selling book Rapid Google Ads Success. It’s the fastest way to reset your foundations, cut through the noise, and remind yourself what really drives performance.

And for a 1:1 personalised consult, book time with me here.