Build Your Book of Business: Google Ads for Financial Advisors

Last Updated on: 31st January 2025, 05:10 pm

Every day, people turn to Google with pressing financial questions that could lead them straight to your expertise. Whether it’s a young couple planning for their first home, a business owner looking for investment advice, or a pensioner navigating wealth preservation, they’re searching for the solutions you provide.

So, in this guide, I’ll show you how to use Google Ads as a financial advisor. Let’s grow your book of business and connect with the right prospects!

Why Financial Advisors Thrive with Google Ads

Google Ads connects you with people who are actively (and sometimes desperately) seeking guidance from expert financial advisors. After all, you’ll help them make potentially life-changing decisions. That’s why financial advising is relational before it’s transactional.

And when it comes time for the transaction, the right ads help clients feel confident in your expertise and integrity before committing to a paid solution.

With that in mind, here’s how to make the most of Google Ads for your business.

How to Grow Your Profits with Google Ads for Financial Advisors

Take Note of Financial Compliance as a Financial Advisor Using Google Ads

Financial services are highly regulated on Google Ads, and for good reason. Your ads need to strike the perfect balance between compelling and compliant. That means:

- Avoiding any language that could be seen as misleading or overpromising, such as “Guaranteed Returns.”

- Clearly outlining your services, qualifications, and terms to build trust and meet regulatory standards.

- Clarifying any specific terms, regulatory disclosures, or limitations on your landing pages to make sure your ads align with industry rules.

Smart Budgeting and Bidding

Now, let’s talk about something that’s right up your alley!

Finance-related keywords can be costly. Terms like “financial advisor near me” or “wealth management services” often carry costs-per-click (CPCs) in the range of $12 to $22, especially for local searches like “financial advisor (city).”

That’s why it’s smart to start with a steady, manageable daily budget – starting from $20 – and let Google’s learning phase gather the data you need.

Once the data rolls in, you can gradually increase your budget. Have a winning ad driving leads for the highest-value consultations? Scale it up!

When to Focus on CPC (Cost Per Click) versus CPA (Cost Per Acquisition) for Bidding?

CPC is what you pay for each ad click, while CPA is the cost tied to a specific action, like a lead or booking. So, when to use each? My two cents:

Stick to CPC early on as it gives you more control levers. Say, if “retirement planning advice” costs $15 a click, you can decide exactly how much traffic you want to drive without overspending.

Once you’ve got data, transition to CPA when you know your numbers. For example, let’s say your average client brings in $3,000 in revenue, and you’re comfortable spending $300 to acquire that lead. Set a $300 CPA target, and let Google find the right people.

When in doubt, ask yourself: “How much is each conversion actually worth to my business?”

If a “financial advisor consultation” keyword costs $20 per click but brings in clients worth $5,000 a year, it’s a highly ROI-positive investment. On the other hand, if you’re advertising a smaller service like a budget review session, keep your bidding more conservative.

Best Practices for Bidding for Google Ads for Financial Advisors

- Use Google Ads’ geo-targeting settings to focus on prospects in your service area. Go to the Campaign Settings tab, expand the Locations section, and define your target area by city, zip code, or radius. Exclude irrelevant areas to avoid wasted spend.

- Set your maximum CPC in the Bidding and Budget section of Google Ads. This is where you tell Google the maximum you’re willing to pay for a click. Over time, Google will adjust your actual CPC based on competition, Quality Score (a combination of ad relevance, landing page experience, and CTR), and ad performance, often charging you less than your maximum bid.

- Allocate higher bids for search terms that show strong intent, like “fee-only financial planner” or “investment advisor for retirement.” A low Quality Score could mean paying $20 per click when it should be $2. Not ideal!

Importantly, you should organise ad groups around specific services, like retirement planning or estate management, to keep your messaging sharp and your Quality Scores high.

Structure Campaigns the Right Way

Google Ads loves structure, and so do successful campaigns. When your campaigns are set up correctly, you ensure your ads land exactly where they need to.

Campaigns, Ad Groups, Keywords

You wouldn’t put “Retirement Planning” and “Small Business Advisory” into the same basket, would you? Each deserves its own campaign so you can speak with more relevance to each group:

- Campaigns are the broad strokes of your strategy. For example, you might have one for “Retirement Planning” and another for “Investment Strategies.” Each campaign will have its own budget, targeting, and bidding setup so that it’s working toward specific goals.

- Ad Groups: Inside your “Retirement Planning” campaign, you’ll create ad groups like “401(k) Rollovers” or “Retirement Planning for Teachers.” This way, your keywords and ads speak to what your audience is searching for.

- Keywords: Keep these as tight as your budget. If someone searches for “financial advisor for teachers,” your ad needs to reflect that. This relevance wins clicks, boosts your Quality Score and keeps your CPCs manageable.

Additionally, if you already have data on conversions in your Google Ads account, consider further refining the audience who sees your ads with audience layering. You’ll still be targeting keywords, but your ads will only appear to prospects who meet your interest criteria.

For example, if you’re offering a retirement planning service, you’d want to optimise your ads for the audience which is in the segment of preparing to retire – as opposed to everyone who might be looking up retirement planning.

For those of you who are more visual, the following flowchart will be helpful:

Are the Right Prospects Seeing Your Financial Advisory Google Ads?

Not all ad placements serve the same purpose, and understanding the difference between the Search Network and Display Network is crucial to maximising your campaigns.

The key difference lies in intent: Search targets users actively seeking answers, while Display works on passive engagement, “planting seeds” for future conversions.

The Search Network is a direct line to high-intent prospects. When someone searches for “wealth management near me” or “retirement planning tips,” your ad appears alongside their search results.

Display Network ads, on the other hand, show up as visually engaging banners on blogs, news sites, or apps. While Display isn’t as conversion-focused, it helps you build trust and stay visible.

Now, for those of you wanting an all-in-one approach, Performance Max (or PMax) campaigns blend elements of Search and Display into a single campaign, extending your reach to YouTube, Gmail, and more.

However, to truly get the most out of PMax, you need a deep understanding of your target audience, as it’s a fully automated campaign type. If you’re curious, check out my guide on the dos and don’ts of running successful PMax campaigns.

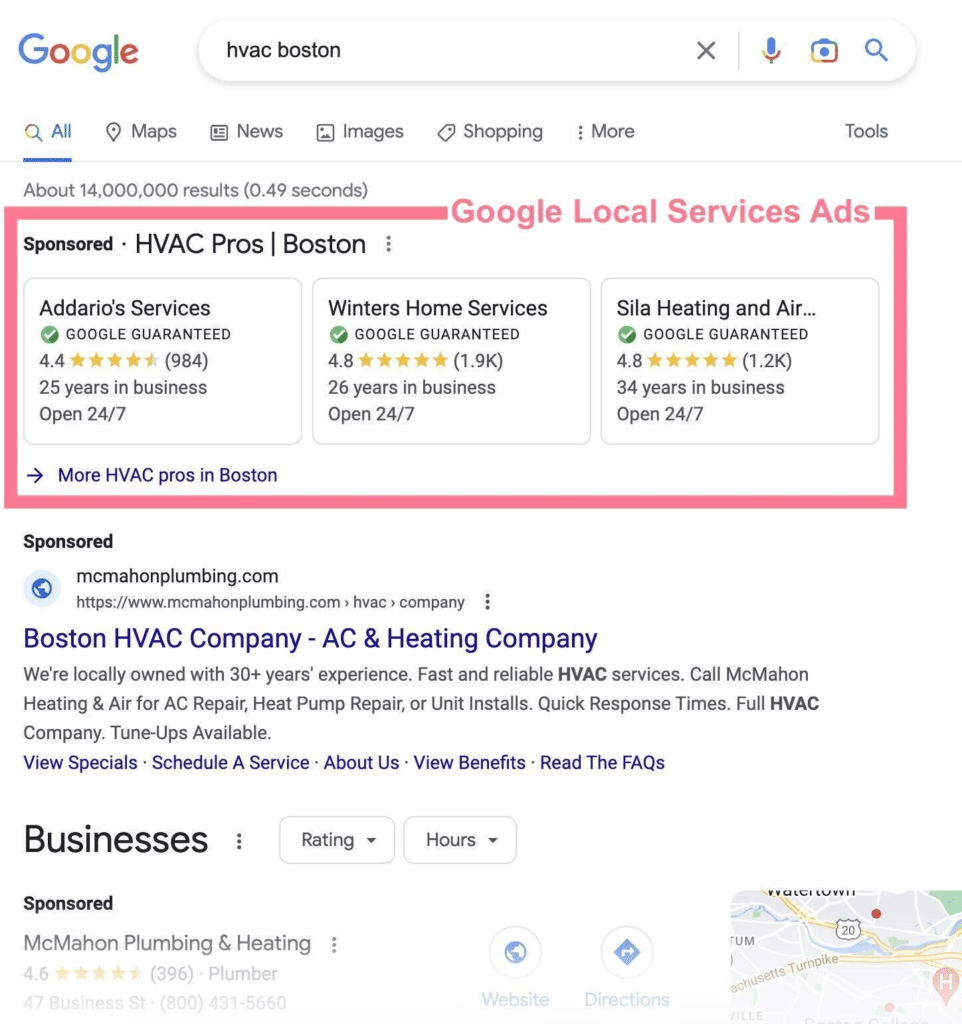

Get Hyper-Local with Google Local Services Ads

If you’re focused on growing your client base in your local community, Google Local Services Ads (LSAs) are a great choice.

LSAs are pay-per-lead ads specifically designed for local businesses that provide services to customers in a particular geographic area, such as financial advisors, plumbers, HVAC specialists, lawyers, and more.

The PPL model means that, unlike traditional PPC Ads, LSAs let you pay only for real leads – calls or messages from prospects. Your budget works harder, delivering actual results instead of just impressions.

These ads also stand out with a bold green “Google Guaranteed” badge.

LSAs prioritise immediacy and proximity-based searches, meaning you’re front and centre for “near me” searches.

However, you won’t find LSAs in your regular Google Ads dashboard:

- Go to the Google Local Services Ads platform

- Complete the verification process. Google will ask for your business details, certifications, and proof of insurance.

- Define your service areas and list your specialities, like retirement planning or small business advising.

- Set a budget based on how many leads you want each month. Since you’re paying per lead, this step is simpler than with traditional ads.

I’ll add: Ask your happiest clients to leave glowing feedback on your profile. Positive reviews directly impact how often your ad shows up.

Craft Relatable and Compelling Headlines and Ad Copy

You have just a few seconds to grab someone’s attention, so your headlines and descriptions need to be compelling.

Here are a couple of examples of ad copy for financial advisors: one highlighting what you should do, and the other one highlighting what you should steer clear from.

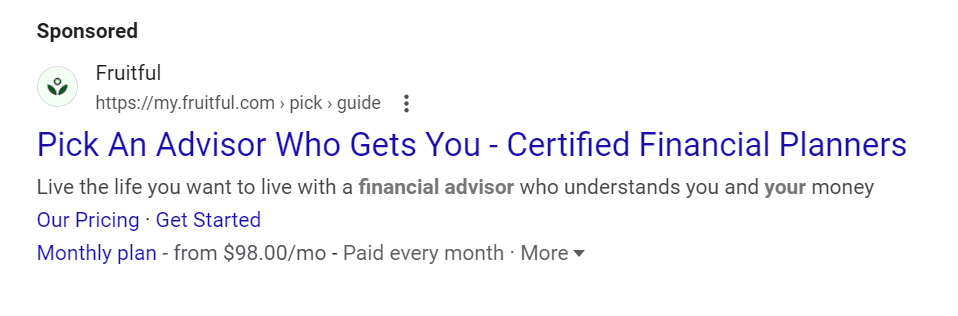

Financial Advisor Ad Example #1

- The headline is personal and to the point. It tackles a key concern (finding someone who truly understands you) while “Certified Financial Planners” adds a much-needed trust factor.

- The description takes it further. It’s not just selling advice; it’s selling a vision of a better life.

- However, upfront pricing in the form of an Ad Asset is the real standout. This kind of transparency isn’t common in financial services. It makes working with a financial advisor feel approachable.

Financial Advisor Ad Example #2

This ad has potential, but let’s break down what could use some work.

- The headline is clear but lacks a hook. It’s descriptive, yes, but doesn’t grab attention or showcase a unique benefit. Where’s the spark?

- The description starts to feel heavy. While offering a free guide is smart, “Answer 8 Critical Questions” sounds more like homework than help. Remember, we’re here for the click – users need to feel curious and excited, not overwhelmed.

Overall, the ad is clear, but it misses a chance to draw users in with excitement and simplicity.

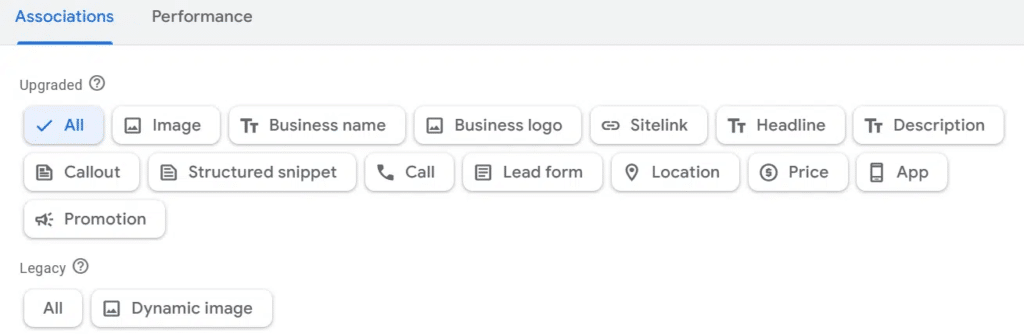

Use Ad Assets to Maximise Your Ad Real Estate

Ad assets (formerly known as ad extensions) expand your ad with extra features and details that make it more useful and eye-catching.

For financial advisors, these can highlight key trust factors, making it easier for potential clients to take the next step –whether that’s calling, scheduling, or learning more about your services.

Here’s a quick look at all available ad assets:

“But, Claire, how do I know how many and which assets to include?”

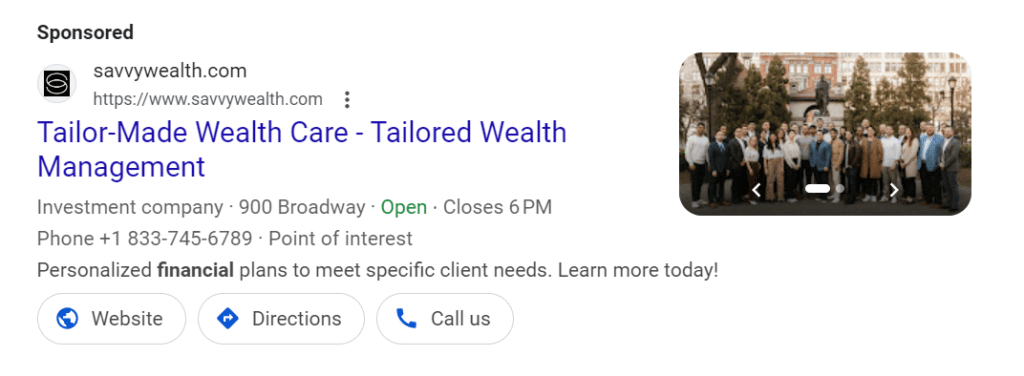

Include more than one asset per ad. For example, the following ad features 3 different assets: Sitelinks, Location, and Call.

A pro tip is to match your ad assets to your goals. If your goal is lead generation, focus on lead forms and calls. If you’re educating and building trust, sitelinks and location assets are your choice.

Those are examples, but as a rule of thumb: always think about what action you want the user to take, and make it as easy as possible for them to do it.

If you’re still in doubt, testing will always be the right answer. And remember to set up conversion tracking so you know exactly which ads are driving results!

Build Your Book of Business for the Year Ahead

Google Ads is one of the most powerful tools financial advisors can use to grow their book of business. As helpful as I want this article to be, you’ll grasp all of the ideas I discussed a lot better if you’re sharp on both theory and practice. Grab my best-selling book Rapid Google Ads Success and let’s make 2025 your best year yet!

One last thing: If Google Ads feels overwhelming, bringing in a PPC expert can save you time and boost your ROI. My team and I are always available to help!

![The Ultimate Guide to Setting Up Google Ads Conversion Tracking [Updated in 2025]](https://a4x3f5i9.delivery.rocketcdn.me/wp-content/uploads/2022/04/conversion-tracking-google-ads-300x180.jpg)